In the recent past, the growing size of the U.S. national debt has become quite a burning issue.

In the last elections, many politicians based their campaigns on tackling this issue. Now, quite a while since the elections, there has been no tangible effort directed at addressing this issue.

This reluctance among the political elite to address this issue has set off alarm bells among financial experts. These experts have already begun preparing for the possible downsides that may arise as a result of the massive debt.

The economy and financial markets are expected to be the worst hit if this unfortunate situation comes to pass. U.S. Money Reserve, America’s Gold Authority®, just released an informational video on the subject.

State of Debt

For you to better understand where the nation’s national debt stands at the moment, you first have to understand the numbers. Today, the national debt stands at $21 trillion and is currently the largest in the world. Moving on to even sadder news, this figure is higher than the GDP of the entire country.

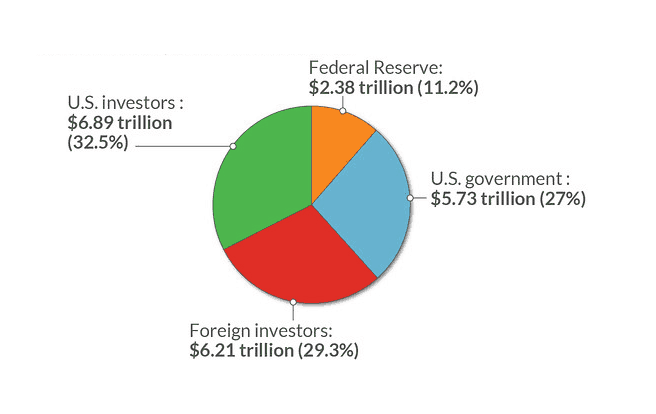

Additionally, this debt carries high interests that have to be paid alongside the money. Among the creditors of the U.S. government are other governments, financial institutions, and private citizens.

Today, the yearly interest paid on this debt is more than the government’s expenditure on any other stand-alone program or department. This interest even surpasses the government’s spending on the military budget, which is always humongous.

The Problem with Having Excessive Debt

Having such massive debt comes with more downsides than upsides. Experts argue that the economy and the financial sector might suffer a huge blow when things get out of control. According to the informational video released by U.S. Money Reserve, repaying such a big loan might take a big toll on the economy, slowing down economic growth.

Additionally, the debt repayment might actually cause a lot of instabilities in the country’s financial systems.

The company suggests that it is essential for anyone looking at the country’s risk exposure as a result of this enormous debt to consider the debt to GDP ratio. As mentioned, the current debt exceeds the GDP. The issuer of gold and other precious metals notes that, as the government struggles to repay its debts, the market uncertainty it might create may make a lot of buyers quite cautious. Buyers taking caution is likely to translate to less purchasing.

This whole occurrence can set off a chain reaction that might lead to the devaluation of commodities and assets on the financial spectrum. The company’s informational video points to a similar occurrence during the 2007–2009 period amid the infamous market crash. The informational video warns that a financial sector drop or stagnation may cause a domino effect to cut through the country.

Contributors to Debt

According to the informational video released by U.S. Money Reserve, most of the debt was accumulated as the government looked for ways to cover for its tax cut deficits and fund projects. Most of the money for funding government activities is raised through taxes. When these taxes are cut, the government cannot raise enough money to fund its projects and programs. The money to fulfill these programs and projects is borrowed as debt.

To avoid digging itself into an even bigger hole, U.S. Money Reserve advises the government to find alternative ways of funding its expenditure in case of deficits. Additionally, the company recommends that individuals seek to hold their money as assets, especially precious metals, to cushion themselves from the harsh economic outcome that may occur due to the enormous national debt.